The Ivy League & Financial Aid: The Ultimate Guide to All of Your Questions

For students who aim to attend one of the eight Ivy League schools one day, a big concern can be how they would pay for tuition and living costs if they got in. After all, there is no doubt that the Ivy League is home to some of the most expensive schools in the world. That isn’t just because of tuition costs, either. Living costs everywhere are increasing, and because some of the Ivies are located in cities, that can also provide a significant financial hurdle. For that reason, you may wonder what kind of financial aid Ivy League schools offer or how much financial assistance Ivy League give.

You’ll be pleased to know that Ivy League universities not only provide financial assistance, but many of them also offer some of the highest financial aid packages to accepted students across the country.

After all, the admissions officers at schools like Harvard, Columbia, and Yale are interested in opening their doors to the most committed and intelligent students in the world, no matter where they come from, what their socio-economic background is, and how much financial aid they need to gain a top-level education without having to take on mountains of student loan debt.

At AdmissionSight, our goals are not just to help the high school (and transfer) students that we work with get into the schools of their dreams; our plans also have to do with helping set our students up for success now and far into the future. For many of our students, that means getting help when it comes to finding the best avenues to secure financial aid, filling out financial aid applications, and much more.

So, if you dream of attending an Ivy League school but are worried about how the financial reality of attending such a school may serve as a barrier, you have come to the right place.

Thanks to the experience that our admissions consultants have in the industry, 75.0 percent of the students we work with end up getting into either an Ivy League program or a school that is not one of the Ivies but is still a top 10 school, like MIT or Stanford. And many of the students we work with also pursue financial aid from these top schools.

For that reason, we wanted to spend some time breaking down the current trends related to financial aid.

What types of financial aid are there?

Before we get into what kind of financial aid Ivy League schools offer specifically, we wanted to first go over the different types of sources of funds that students pursue when looking for ways to afford colleges and universities in the United States.

As many know, schools in the United States have become increasingly expensive. While even the best schools used to be just a couple of thousand dollars a year, and students could quickly pay for their tuition with a part-time job, school tuition now resembles the cost of home mortgages. It’s become a barrier for many students all over the country and the rest of the world.

There are many different kinds of financial aid that students can pursue. Knowing the difference between these options is essential because they can come with very different pros and cons.

Let’s break them all down together.

Federal financial aid

The Free Application for Federal Student Aid (FAFSA) is the primary route that students go through every application cycle when it comes to students getting financial aid. While the support that students get as a result is a popular form of financial assistance, students must know that some of the money they can get through this aid is styled as a loan. That means some students’ financial aid must be paid back. The money is free for other students, and other students are allowed to participate in a work-study, which offers them a job on campus and helps them pay for their schooling.

While this is a popular form of financial aid, average amounts are approximately $9,000 per student. That isn’t putting much of a dent in the average Ivy League tuition, which totals roughly $56,750 annually.

State financial aid

Some states have separate financial aid programs, and all states offer reduced tuition for in-state students attending state-funded universities. State aid has much more variance than federal aid, and what opportunities are available to you depends entirely on your state of residence.

Of note here is that many states have been cutting funding to public universities, causing those universities to increase tuition rates to remain solvent. While some states are trying to reverse this trend, others are not. While public universities generally remain far less expensive than their private counterparts, the gap is narrowing.

So, how do Ivy League schools determine financial aid? One of the most important things to know regarding this question is that all eight of the Ivies are “need-blind,” as they put it. What this means is that in no part of the application.

Student loans

Unless you’ve been living under a rock, chances are good that you have heard about student loans. These are government loans that are guaranteed for students by the government. That can seem significant, as students can access the money they need to attend the school they want. On top of that, students do not need to begin repaying the loans until they finish their education.

However, that is basically where the good news ends. These loans come with interest rates and, unlike other loans, cannot be written off in the case of bankruptcy. For that reason, millions of Americans have been saddled with tens of thousands of dollars worth of debt over the last few decades. By this point, it is generally advised that students do not take out these kinds of loans unless they plan on pursuing a field of study that can yield higher-income jobs, such as a STEM major or business.

Aid directly from colleges

Last but not least, we wanted to cover the need-based or merit-based scholarships that come directly from schools and their enormous endowments.

Many schools offer Merit-based scholarships, which can provide students with what is known as a “full ride.” Merit-based aid is given to students whom a given school deems so impressive that it is willing to spend money to have that student attend. Many of the schools that offer these merit-based scholarships are some of the most prominent public schools in the country, such as:

- Ohio State University

- Penn State University

- University of Arizona

- University of California at Berkeley

- University of California at San Diego

- University of Colorado

- University of North Carolina at Chapel Hill

- University of Virginia

- University of Washington

- University of Wisconsin

- And many more!

As you may have noticed, none of the Ivy League schools are on that list. The reason? Ivy League schools only offer need-based financial aid to students. After all, every student offered a spot at an Ivy League school arguably deserves financial assistance based on merit.

The Ivy League is proud that each school prioritizes meeting 100 percent of demonstrated needs.

What kind of financial aid do Ivy League schools offer?

Suppose you want to attend an Ivy League school. In that case, you may ask, “What kind of financial aid do Ivy League schools offer?” Plus, “How much financial aid do Ivy League give?” After all, the percentage of students that get need-based financial aid and the average amount that those students get could play a rather significant role in where you choose to apply and ultimately attend.

Though exact statistics of the most recent years are hard to equate, as not all of the information is easy to come by, we have found all the most related information from the academic year. Since that was just a few years ago, the reality is that these numbers are likely still very accurate to the current trends in the Ivy League.

If you want to know what kind of financial aid Ivy League schools offer, take a look at the main numbers as they relate to how much financial aid each Ivy League school offered in that school year:

| All Undergraduate Financial Aid Statistics Between Colleges In Ivy League | |||

|---|---|---|---|

| Name | Number Receiving Aid | Percent Receiving Aid | Average Amount |

| Yale University | 3,440 | 56% | $58,244 |

| Harvard University | 4,260 | 42% | $52,257 |

| Dartmouth College | 2,338 | 52% | $47,411 |

| Princeton University | 3,305 | 61% | $56,126 |

| Columbia University in the City of New York | 4,869 | 59% | $45,881 |

| Cornell University | 7,051 | 47% | $49,149 |

| University of Pennsylvania | 6,009 | 51% | $44,232 |

| Brown University | 3,308 | 46% | $47,590 |

| Average | 4,323 | 51.75% | $50,111 |

As you can see, every Ivy League school offers ample financial aid to the students who get in and attend each school. However, these final numbers tell just one part of the story.

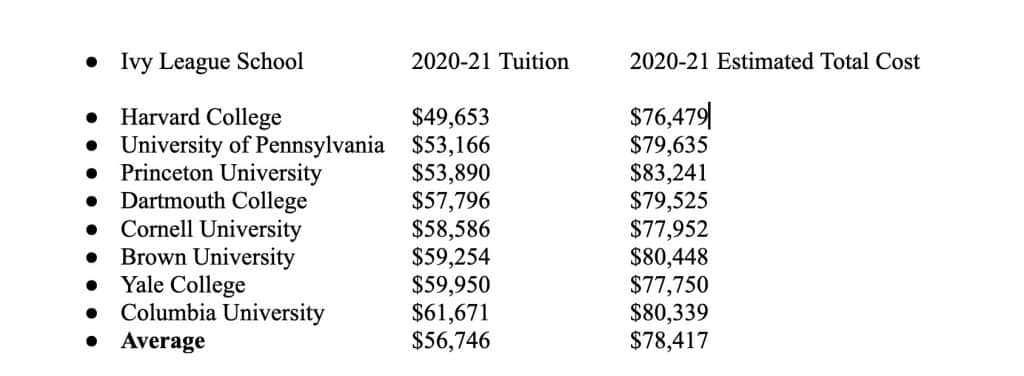

After all, though those are undoubtedly high numbers in terms of the average amount of aid, the actual cost of attending an Ivy League school is quite a bit higher when the cost of attendance and fees are also considered. Here is a table to show the difference between tuition and the total cost of attending an Ivy League school.

As you can see, the estimated total cost at these schools can be almost double that of just the tuition. Many students need to remember this, and it’s part of why so many students apply for aid no matter which Ivy League they want.

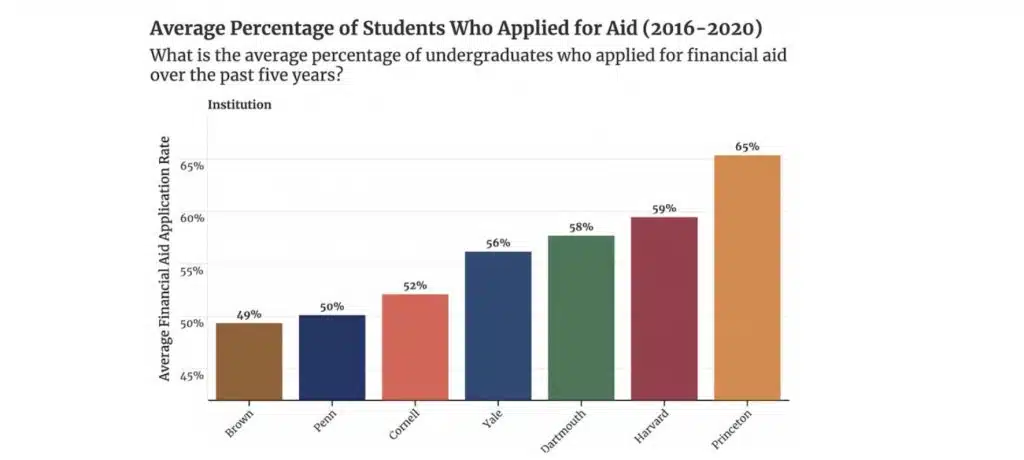

Regarding which schools got the most financial aid applications, here is a graph that clearly shows what percentage of students who applied also applied for financial aid. As you will see, the rates vary widely from as low as 49 percent for Brown University to 65 percent for Princeton University.

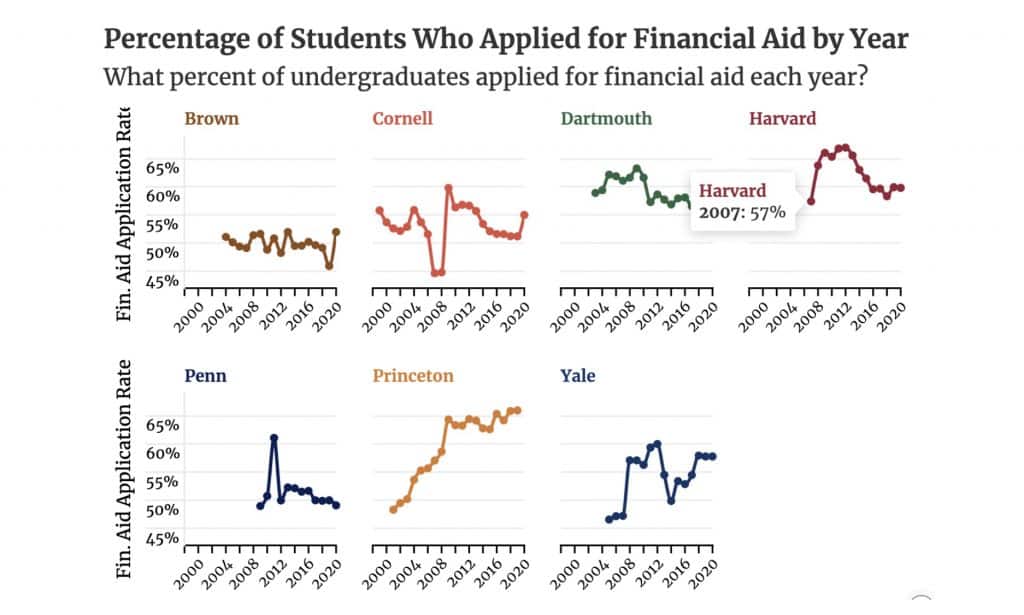

Perhaps even more interesting, we’ve also found a graph showing the rate of change in the percentage of students who applied for financial aid from the early 2000s to 2020. It is interesting to note that some schools have seen massive fluctuations.

In contrast, others have seen steady and consistent growth, and other schools have seen a general stasis regarding financial aid applications. Take a look below:

How to apply for financial aid at an Ivy League school?

You may be wondering what students must do to apply for that need-based financial aid that the eight Ivy League schools love giving out to students who have been accepted to the school.

While each Ivy League school has somewhat different practices regarding how they field and decide upon need-based financial aid benefits, the information they need tends to be the same from one school to the next.

For that reason, we thought the easiest way to take care of this would be to offer what Harvard has to say about its process:

“The financial aid application process is essentially the same for all students – regardless of nationality or citizenship,” the school says. “You will be asked to provide information about your family income and assets, outside awards, and any unusual or changed financial circumstances. Our financial aid officers work closely with you to determine your demonstrated need and your family’s expected contribution. Once we have reviewed your information and determined your demonstrated need, you will be notified of your award for the coming year.”

From this alone, it should be clear that the Ivy League makes it a priority to ensure that the students who deserve to get into a school like Yale, Princeton, or Harvard do not have to end up settling for anything less simply because they are worried about how they are going to foot the bill.

It is one of the prime benefits of the eight Ivies having such massive endowment funds that they can dip into to help make the dreams of attending an Ivy League school come true for thousands of students every school year.

Ivy League financial aid

Based on the current trends that we have seen over the last few years, there is a clear indication that more students than ever are currently applying to Ivy League schools. There are many different reasons for that.

Still, one of the primary reasons is that these schools want to improve and increase the diversity of their student body and alums base by making an Ivy League education less of a financial hurdle to jump over than ever before.

Though these schools are indeed the elite of the elite, that does not mean that only a tiny percentage of the popular who can afford to attend such a school should be the only kinds of students lucky enough to enroll.

That’s why knowing what kind of financial aid Ivy League schools offer is essential. It can remind you that even if you cannot afford the massive bill of attending an Ivy League, the schools themselves are willing and able to help you.

So, if you are a committed high school student with dreams of attending Brown or, Columbia or Cornell, don’t let the concern that you might be able to afford the school get in the way of you applying.

If you are curious about ways to ensure that you get into your dream school and receive the need-based aid that you require to enroll, contact AdmissionSight today to schedule a free consultation to learn more.